What if your most critical customer insight is hiding in a support ticket, not a survey? And what if the standard metrics are only telling you what happened, not what to do next?

For subscription businesses with 1,000+ monthly support conversations, this poses a revenue problem.

Think about it: your support team closed 5,400 tickets last month tagged "account issue." Your CS team sees usage dropping for 23 enterprise accounts. Your product team logged 47 bug reports about billing errors.

But nobody connects these signals until cancellation notices arrive, and by then you've lost significant ARR that was preventable.

Traditional VoC programs collect lagging indicators that only tell you about churn after it happens. In 2026, you need leading signals that come directly from the operational intelligence buried in actual customer conversations, revealing retention risks as soon as possible.

Let us explore the role of Voice of the Customer feedback and how AI-native operational intelligence converts scattered feedback into real-time retention action.

What Exactly Is Voice of the Customer Feedback?

As you’re aware, the Voice of the Customer feedback means capturing, analyzing, and acting on everything your customers tell you about their experiences with your business platform.

Since it is not just a single survey or a collection of support tickets, it goes beyond generic data collection.

For instance, a customer complaining about a 'glitchy checkout process' in a chat, leaving a 3-star review that says 'delivery was slower than expected,' and giving a low NPS score without a comment are all pieces of the same feedback.

Therefore, the ultimate Voice of the Customer feedback goal is to make specific changes that resolve frictions, enhance positive experiences, and build customer loyalty that fuels long-term growth and combats churn.

Why Legacy VoC Approaches Fail for Subscription Business Retention

Simply put, traditional VoC programs were built for measurement, not prevention. Here's where they break down:

1. Survey-based approaches tell you what already happened:

Your NPS survey last quarter showed a 42 (acceptable). But three enterprise accounts (worth $180K ARR) canceled this month, citing "integration issues." Those same accounts opened 23 support tickets about SSO problems over the past 60 days.

These are the signals your survey-based VoC program never captured until the exit interview.

2. Fragmented data hides cross-team patterns:

Support tags 847 tickets as "login issue." Customer Success sees activation stalling for 15 high-value accounts. Product logs authentication failures spiking 320%.

Three teams, three systems, same root cause, but nobody connects the dots until churn reports show the damage.

3. Manual analysis cannot scale to operational speed:

When you're processing 8,000+ monthly conversations, sampling 200 tickets for "themes" means you're analyzing 2.5% of your signal. The billing bug affecting your highest-tier customers? It's buried in the 97.5% you never reviewed.

For subscription businesses where churn reduction can significantly increase profits, legacy VoC's retrospective reporting model costs you preventable revenue loss every month.

Now, let’s go over the different VoC feedback metrics and how they quantify regular customer thought processes.

Popular Voice of the Customer Feedback Metrics

You must have used NPS, CSAT, and CES as the core metrics for gauging customer sentiment. These metrics do matter, but for subscription businesses focused on retention, they share a critical limitation: they're lagging indicators.:

- Net Promoter Score (NPS): Measures loyalty quarterly or monthly. By the time your score drops from 45 to 38, you've already lost the accounts that drove the decline. It tells you sentiment shifted, not why or when to intervene.

- Customer Satisfaction Score (CSAT): Captures satisfaction post-interaction. Useful for measuring individual touchpoints, but a customer can rate their last support call 5/5 and still churn 30 days later because of a product issue that never surfaced.

- Customer Effort Score (CES): Tracks friction in specific processes. Effective for streamlining support workflows, but doesn't connect effort scores to broader retention risk or reveal patterns across your customer base.

- Churn Rate: The ultimate retention metric. However, it's retrospective. When churn spikes, you're calculating damage that's already done, not catching the operational signals that predicted it.

- First Contact Resolution (FCR): Low FCR flags agent training gaps or product complexity. But measuring resolution rates doesn't explain what's causing repeat contacts or which unresolved issues create churn risk.

- Customer Lifetime Value (CLV): Effective VoC feedback programs that improve experience directly increase CLV by extending customer relationships and increasing purchase frequency.

Advanced VoC feedback programs don't work in isolation. What subscription businesses need are leading operational signals:

- The spike in "billing error" tickets from enterprise accounts 45 days before renewal

- The pattern of "can't find feature X" conversations correlating with activation stalls

- The authentication failures affecting your highest-value segment

That's where AI-native VoC transforms the equation. Instead of waiting for quarterly NPS to reveal problems, you analyze 100% of support conversations, calls, and feedback in real time to detect churn drivers while they're still preventable.

Now that we have quickly revised the common VoC feedback metrics, let’s get into the details of some common feedback methods and their implementation.

Common Feedback Methods: Which to Use and How

‘How to collect Voice of the Customer feedback?’

It is a common question most CX teams and leadership ask. Surveys, interviews, and support tickets are primary Voice of the Customer feedback channels. On the other hand, reviews and social listening capture indirect sentiment.

The most suitable method is determined by your immediate business question. Here’s how:

1. Direct Feedback Methods

- Surveys (CSAT, NPS, CES): These have been the workhorses of VoC. However, they are also retrospective and scheduled, as we noted earlier.

You send an NPS survey quarterly. A customer rates you 6/10 in March, citing "integration problems." By the time you analyze results in April, that account will have churned.

- Customer Interviews: One-on-one, in-depth conversations offer rich, detailed context about the customer's journey, motivations, and pain points. They are perfect for exploring complex issues, but are time-consuming and not scalable for large audiences.

For example, you can interview 15 customers monthly to understand journey friction. Meanwhile, 8,000+ support conversations contain the same insights at scale. Interviews reveal the "why" behind patterns, but operational data reveals the patterns first.

- Focus groups: Generate ideas through discussion, but group dynamics skew individual experiences. Useful for product development, less effective for detecting account-specific retention risk in real time.

2. Indirect Feedback Methods

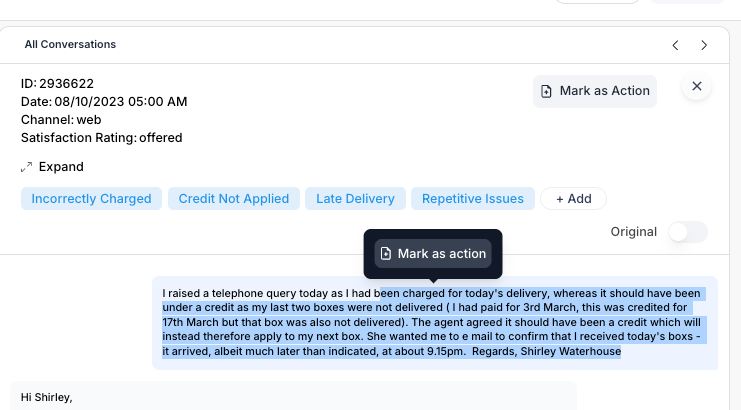

- Support tickets and call logs: This is eal-time, unsolicited, and action-specific. When a $50K ARR account opens three tickets about "SSO failures" in 30 days, that's a leading indicator. They haven't filled out your quarterly survey yet. They haven't churned yet. But the retention risk is visible now, while you can still fix the authentication issue and save the account.

For subscription businesses processing thousands of monthly conversations, this operational feedback is where churn signals hide.

The problem is, most teams can't analyze 100% of conversations at scale, so they often tend to sample 200 tickets and miss the patterns affecting their highest-value segments.

- Online reviews (App Stores, G2, Trustpilot): Public feedback heavily influences your brand reputation and potential customers. It highlights your strengths and weaknesses from a market perspective.

- Social media comments: An unfiltered channel for customer sentiment, it’s great for spotting emerging PR issues and understanding brand perception, but it can be noisy and hard to analyze at scale.

Now, here’s the question that often gets asked:

Common Mistakes While Running Voice of the Customer Feedback Programs and Solutions

Mistakes in VoC programs, such as inactive feedback, focusing on conventional indicators, and isolated data, lead to false metrics and customer loss. Correcting these errors involves clear ownership, unified data, and predictive insight.

Here are the common pitfalls, and how you can avoid them:

1. Collecting Feedback but Not Acting on It

This is the most frequent and damaging error. Sending out surveys and then doing nothing erodes customer trust.

For example, a SaaS company tracks a 20-point drop in CSAT for their onboarding team but takes three weeks to form a committee to investigate. By then, churn has already spiked.

The Fix:

- Assign clear owners for key feedback themes (e.g., 'Checkout Errors' owned by the Product Manager, 'Shipping Delays' owned by Logistics).

- Implement a closed-loop workflow where Detractors are automatically flagged for follow-up within a set SLA (e.g., 24 hours).

2. Operating with Data Silos

When survey data lives with marketing, support tickets with operations, and call recordings with a separate QA team, no one has the complete picture.

For example, the product team (for example) is celebrating a high NPS, unaware that support tickets about a new feature have doubled, creating a massive operational cost.

The Fix: Break down silos by implementing customer feedback management platforms that unify all feedback channels into a single source of truth.

3. Prioritizing Volume over Reliability

Manually tagging thousands of tickets with generic and pre-defined tags can be a recipe for inaccurate data. One agent might tag a login issue as 'Password Problem,' while another uses 'Can't Access Account.'

The resulting reports are unreliable. You can't spot patterns when your tagging system fragments them. A widespread authentication issue affecting renewals looks like dozens of unrelated incidents instead of one critical problem demanding immediate action.

The Fix: Use AI-native analysis that applies consistent tags across all feedback. SentiSum's Kyo AI Engine automatically categorizes conversations by understanding context, not keywords, and routes specific issues to the responsible teams while they're still preventable.

4. Ignoring the Silent Majority

Focusing solely on angry ‘Detractors’ and happy ‘Promoters’ leaves the silent majority: the ‘Passives’ unaddressed. This group is often on the fence and represents the largest, most at-risk segment for churn.

The Fix:

- Proactively analyze feedback from Passives.

- Understand what's holding them back from becoming Promoters.

- Launch targeted initiatives to address these ‘good but not great’ experience gaps to move them into loyal advocate territory.

5. Waiting for Scores to Drop

NPS and CSAT are lagging indicators, as we have shown. The goal is to find leading indicators, like a sudden spike in tickets about a specific feature, that allow you to act before scores plummet and customers leave.

The Fix:

- Monitor operational data and low-friction feedback channels.

- Track real-time signals like repeated help article searches or a drop in feature usage within analytics.

These leading indicators alert teams to problems before customers complete a traditional survey.

SentiSum not only addresses these common mistakes but transforms their root cause: disconnected data. Let’s explore how.

How SentiSum Analyzes Voice of the Customer Feedback in Real-Time

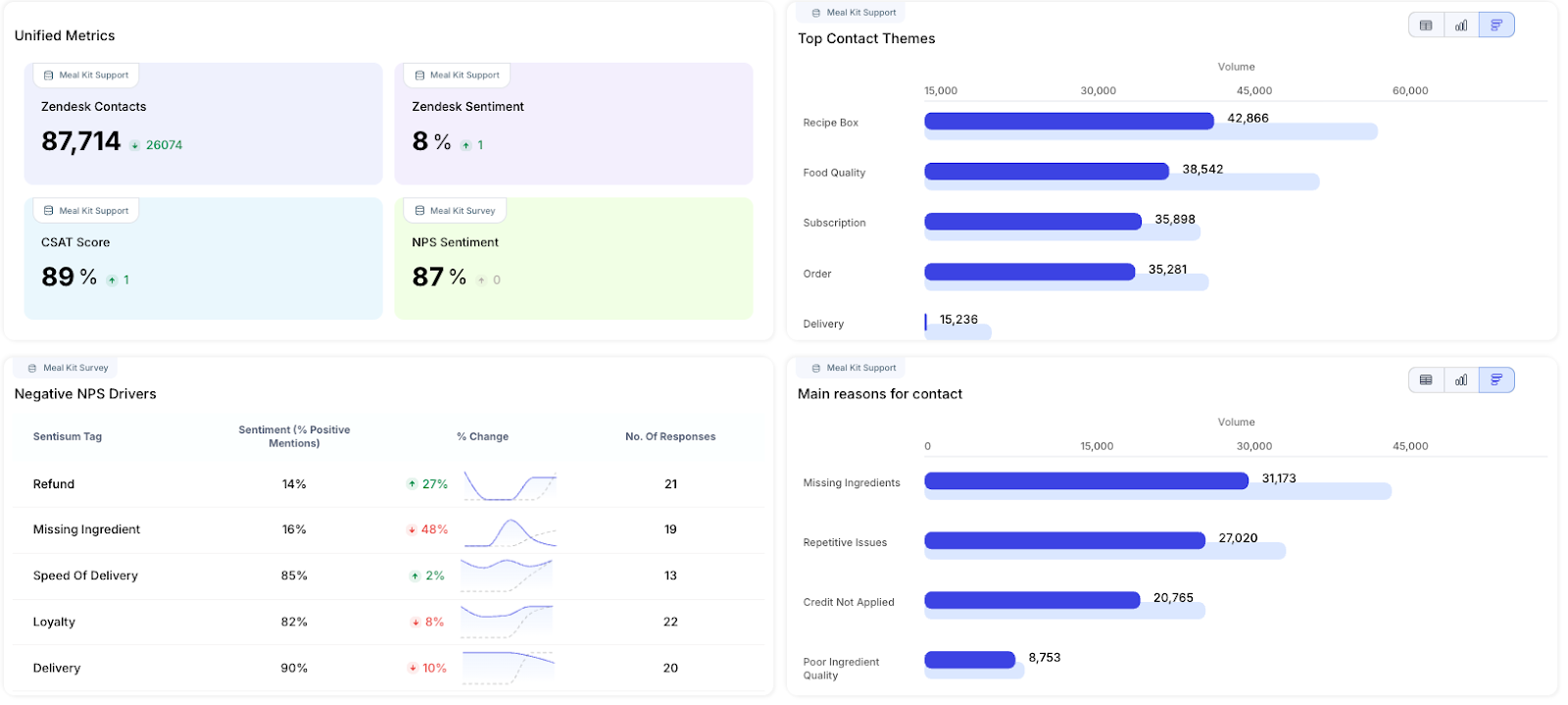

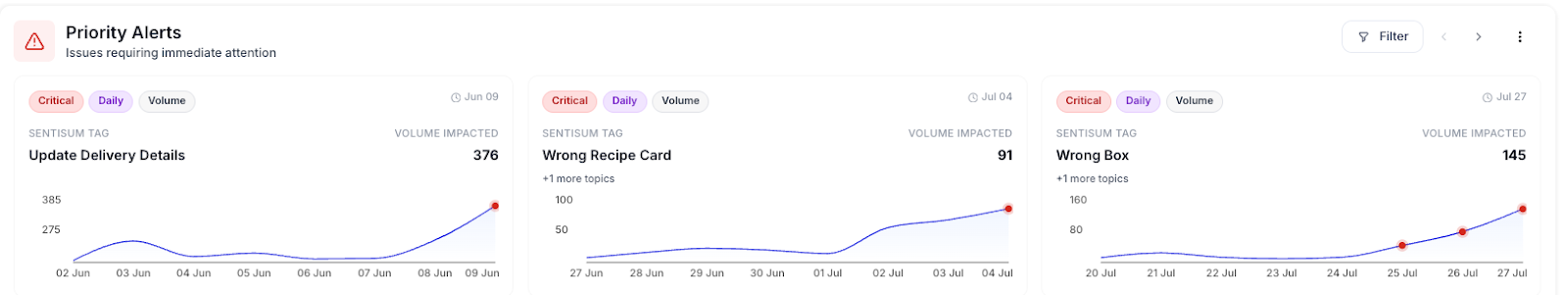

As an AI-native VoC platform, SentiSum directly addresses traditional VoC feedback programs gaps by unifying every customer touchpoint and using AI to explain the real reasons behind churn, frustration, and loyalty.

Here’s how SentiSum works in practice:

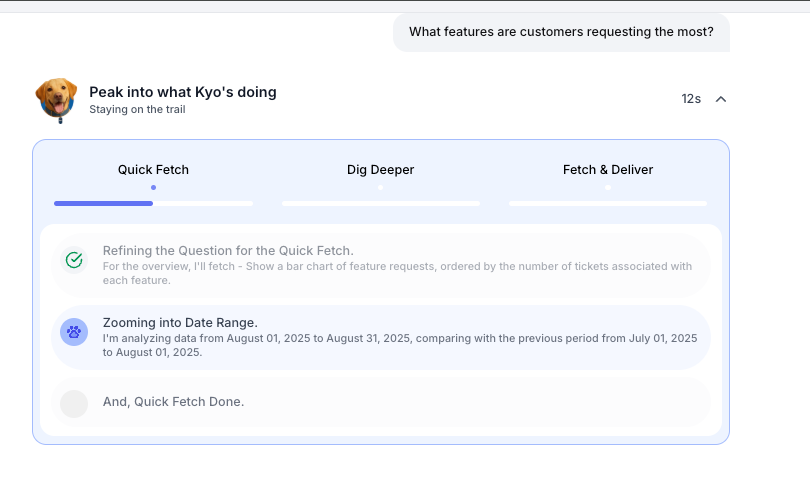

Interpret Conversations in Real Time with Kyo

Kyo, SentiSum's AI agent, powers three specialized agents:

- Early Warning Agent detects the anomaly. It detects when your authentication failure rate for enterprise accounts spiked 340% in the last 48 hours, affecting high-value accounts.

- Insights Agent explains why. Root cause analysis shows your SSO integration, updated Friday evening, is incompatible with Okta instances using legacy configurations. It also shows the percentage of affected accounts in your highest-value tier.

- Unified Signals connects the dots across teams: Support sees tickets about login issues. Customer Success notices activation stalling for enterprise accounts. Product logs show authentication timeouts clustering in the same segment. Three teams, same problem, but nobody properly connected it until Unified Signals revealed the pattern.

Together, they provide proactive monitoring of your customer experience. Simply ask, “Which accounts showing churn risk mentioned billing issues in the past 60 days?" or "What's driving support volume spikes from our highest-value segment?" Kyo will provide a summarized answer, backed by all your unified feedback data.

It saves countless hours of manual digging and empowers CX, product, and leadership in the company to find the insights they need, without data science expertise.

Unify Every Voice From All Channels in One Place

SentiSum integrates smoothly with your support desks (Zendesk, Intercom), survey tools (SurveyMonkey, Typeform), review sites (G2, Trustpilot), and social media. It eliminates data silos, giving you a complete, real-time feedback analysis of the customer journey.

For example, a support ticket in Zendesk, a low score in a SurveyMonkey response, and a negative comment on Facebook can all stem from the same product issue. When isolated, each seems minor. But once you connect the dots via SentiSum, they can reveal a pattern demanding immediate attention.

This way, you no longer have to wonder if the issue mentioned in a support ticket is the same one dragging down your NPS.

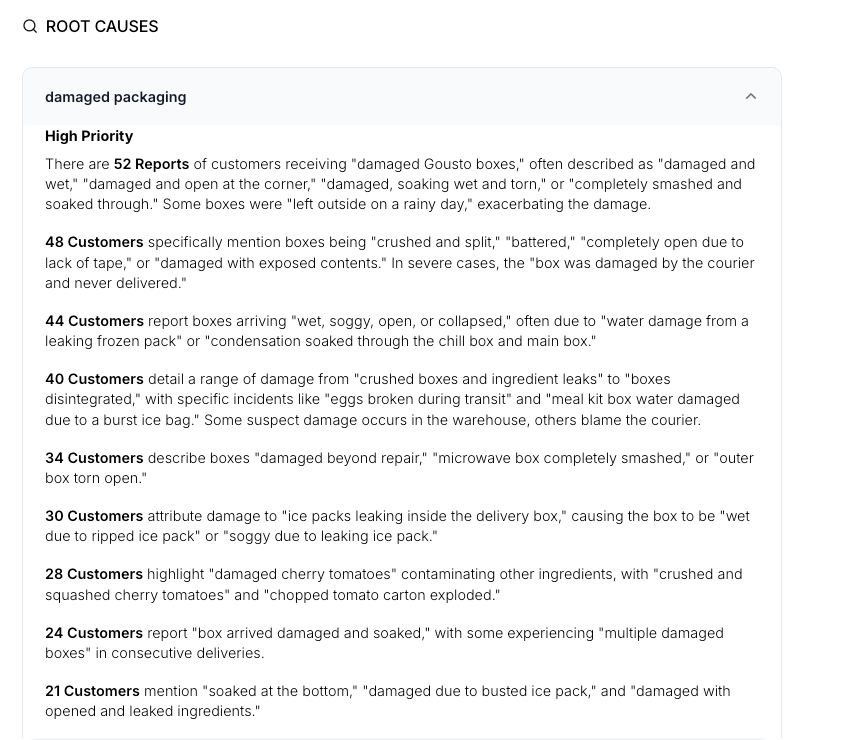

Understand the Why Behind Customer Sentiment with Granular Tagging

SentiSum goes beyond simple keyword matching. Using advanced Natural Language Processing (NLP), it understands context and nuance.

As a case in point, a ticket about a 'payment failure' with high negative sentiment can be flagged as critical and routed directly to a finance specialist, while a 'feature request' can be sent to the product team. It allows you to perform precise root cause analysis.

For instance, you can identify that 62% of ‘checkout failed’ tickets originate from a single third-party payment gateway, providing the evidence you need to renegotiate or change partners.

Transform Channels Like Phone Calls Into Rich Insight

While most platforms transcribe and tag calls, the critical question remains: are you discovering why customers call? Basic tagging counts mentions; it cannot interpret nuanced emotion or connect disparate conversations to reveal root causes.

SentiSum decodes intent by analyzing language patterns across 100% of calls to pinpoint the exact drivers behind churn, loyalty, and recurring issues.

You can search calls just like text, understanding the drivers of call volume, agent performance trends, and the nuanced issues customers only explain over the phone.

Build a Tailored AI Model for Your Business

Most customer feedback tools force your feedback into a fixed set of categories; SentiSum’s AI learns your business from the ground up. It understands your product names, internal processes, and the exact language your customers use.

This means it distinguishes that 'calendar sync is broken' is a different problem from 'meeting reminders arrive late.' For subscription businesses, such precision is critical.

When you can accurately categorize which integration issues affect enterprise accounts approaching renewal versus general feature requests, you prioritize fixes that defend revenue, not just improve satisfaction scores.

Best Practices for Collecting and Acting on Voice of the Customer Feedback

Core actions like sharing insights company-wide, responding directly to customers, and linking data to revenue transform raw feedback into results. Let’s see how:

1. Share Insights Across the Entire Organization

VoC data should not be confined to the CX team. Product teams need to know what features are causing confusion. Marketing needs to understand if the brand promise matches the actual experience. Operations need to see process breakdowns.

- Integrate VoC feedback findings directly into team workflows. Push trending bug reports into Jira or GitHub.

- Share rising customer compliments in Slack to boost morale.

- Alert the logistics team to a shipping delay trend via email digest.

- Embed customer context directly into the tools your teams use daily.

2. Close the Loop with Customers

When a customer reports a critical issue or gives a low score, have a process to follow up with them directly.

In other words, aim for active feedback loop management as it shows you’re listening and can turn a detractor into a promoter.

For example, if a customer rates their experience a 1/5 and mentions a bug, your success team can reach out, apologize, inform them that the bug is being fixed, and offer a small credit.

3. Connect Feedback to Financial Impact

To secure buy-in for customer experience initiatives, you must speak the language of business: revenue. Quantify how feedback impacts your bottom line.

For instance, calculate that the 'login issues' mentioned by 15% of churning customers represent an estimated $250,000 in lost MRR.

4. Link Feedback Themes Directly to Customer Segments

Don't analyze feedback in a vacuum. Segment actionable customer feedback insights by client persona (e.g., Small Business vs. Enterprise), journey stage (Onboarding vs. Renewal), or product line.

This reveals that Enterprise clients struggle with integration, while new users fail during activation.

5. Focus on Reducing Customer Effort

Low effort is a stronger predictor of loyalty than high satisfaction. Use CES and analyze support conversations to map where customers struggle. Identify repetitive contacts, confusing processes, and knowledge gaps.

Fixing these friction points reduces ticket volume, lowers costs, and creates a smoother experience that customers remember.

Read more about the best practices to improve CX in 2026.

Why SentiSum Is a Top Choice When It Comes to VoC Feedback?

Choosing a customer feedback management platform comes down to one question: Does it tell you why things are happening in time to make a difference?

SentiSum is engineered specifically for that purpose.

As noted, other customer feedback tools provide generic dashboards and metrics. Our AI-native approach delivers direct intelligence:

- Precision analysis: Custom AI uncovers the exact drivers of churn, frustration, and loyalty by analyzing conversations.

- Integrated action: Seamless connections embed insights into daily workflows, moving teams from awareness to action without disruption.

- Proactive resolution: Replace reactive reporting with real-time feedback analysis, eliminating manual work and enabling confident leadership.

This is how you build an experience that doesn't just satisfy customers but actively retains them.

➡️ Read More

From Siloed Feedback to Instant Action: How JustPark Fixed Problems Before They Cost Thousands

📽️You can also watch the full video here:

SentiSum x JustPark | JustPark Turns Driver Feedback Into Instant CX Wins (Case Study)

Conclusion

VoC feedback is only as valuable as the action it prompts.

When the right insight reaches the right team at the right time, feedback stops being data and starts driving decisions. Stop letting valuable, actionable customer feedback insights languish in disconnected systems.

To see how SentiSum can uncover the specific drivers of churn and loyalty in your unique customer conversations, book a personalized demo today.

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

.webp)

.webp)

.svg)