Have you ever wondered what a customer truly thinks the moment they finish an interaction with your business?

Surveys are designed to answer that exact question. They are typically deployed immediately after a specific touchpoint, such as a customer support call, a purchase, or a website chat session. Goal? To capture a precise snapshot of the customer's experience while the memory is fresh.

And while surveys do a great job of capturing quick reactions, the real question is: are they enough to represent the full Voice of the Customer?

In this guide, we explore the different Voice of the Customer surveys and their intended uses. More importantly, we examine whether relying on them alone is a good decision or not.

What Is a Voice of the Customer Survey?

A Voice of the Customer survey is a direct inquiry to understand your customers' expectations, experiences, and frustrations.

These surveys systematically collect feedback on your product, service, or brand to transform subjective opinions into structured, quantitative, and qualitative data. The goal is to move beyond assumptions and grasp the reality of the customer journey.

Here’s an effective Voice of the Customer survey example: a hotel chain might discover through an open-ended survey question that guests value a quick, contactless check-in process more than a complimentary welcome drink (an insight that can redefine small investment priorities).

Below are some common Voice of the Customer survey questions that businesses use to gather crucial insight:

- On a scale of 1-10, how likely are you to recommend our company to a friend?

- What was the primary reason for your score?

- What is one thing we could do to improve your experience?

- Did our product help you achieve your goal today?

Why Do You Need Voice of the Customer Surveys?

Common VoC methods (support tickets, social listening, review sites, or sales calls) are invaluable but can sometimes provide a fragmented or biased view. They often capture extreme emotions during a crisis or negotiation, not the typical user's calm, everyday experience.

VoC surveys address this, offering distinct advantages; some are decoded below:

- They engage the silent majority. Most customers do not contact support. They simply use your product and, if dissatisfied, may leave without a trace. Surveys are a channel to directly engage this segment, whose feedback is often the most representative.

- VoC surveys provide comparable, trackable data. Unlike anecdotal conversations, surveys ask the same specific questions to a wide audience. This allows you to track changes over time, compare segments, and identify statistically significant trends.

- VoC surveys also offer context and specificity. A one-star review tells you a customer is angry, but not why. A direct survey allows you to ask targeted follow-up questions to get the precise details.

The Ultimate Goal

VoC surveys are done to align business decisions with actual customer needs, not internal or biased assumptions. This also helps prevent wasted resources on unwanted features and helps prioritize improvements that directly impact revenue, retention, and loyalty.

Also, a unique, often overlooked aspect is its role in predicting future behavior. By analyzing verbatim comments, companies can identify emerging problems or desires before they affect churn rates.

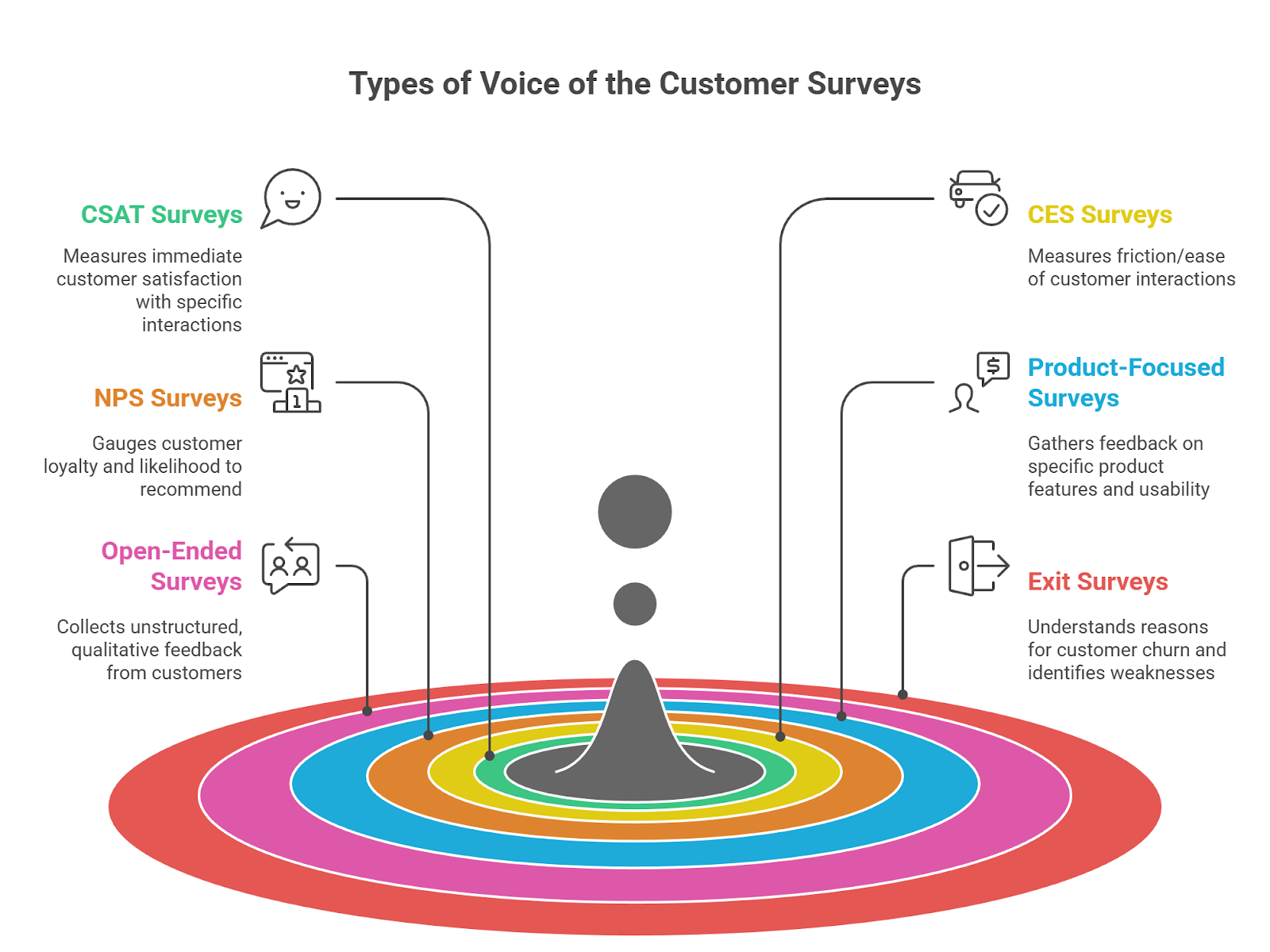

Types of Voice of the Customer Surveys

VoC surveys come in several forms, each created to capture feedback at different stages of the customer journey and reveal unique insights into satisfaction, loyalty, and experience:

1. CSAT (Customer Satisfaction Score) Surveys

The Customer Satisfaction Score is a transactional metric focused on a recent, specific interaction. It typically asks a simple question like, ‘How satisfied were you with your experience?’ on a scale of 1 to 5.

But what does a CSAT score truly tell you? It measures the customer's immediate emotional response to a single event: a support call, a purchase, a website interaction. Its primary strength is measuring immediate, transactional happiness. For instance, after a support call, a high CSAT score confirms the agent resolved the issue effectively.

However, its limitation is its narrow scope; a customer can have a high CSAT for a single transaction but still be at risk of churning due to broader issues. Hence, it’s a lagging indicator.

2. CES (Customer Effort Score) Surveys

While CSAT measures satisfaction, CES measures friction. For instance, it asks the customer, ‘How easy was it to get your issue resolved?’

The philosophy behind CES is that customer loyalty is heavily influenced by the ease of doing business (for example, a high-effort experience, such as being transferred between agents or repeating information).

Customers who have to expend significant effort are more likely to become disloyal. Therefore, CES is a powerful leading indicator for churn. And is particularly valuable for optimizing customer service, onboarding, and returns processes. It identifies friction points that, when eliminated, can lead to a significant decrease in future support contacts and an increase in customer retention.

CES’s major strength lies in its ability to measure process efficiency from the customer's perspective.

3. NPS® (Net Promoter Score®) Surveys

Unlike transactional surveys, the Net Promoter Score is a relational metric. It asks the foundational question, ‘On a scale of 0-10, how likely are you to recommend our company to a friend or colleague?’

Respondents are classified as Promoters (9-10), Passives (7-8), or Detractors (0-6). The resulting score is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

However, the numeric score is just the starting point. The strategic goldmine is the open-ended follow-up question: ‘What is the primary reason for your score?’ They reveal the true core drivers of loyalty (e.g., product reliability, customer service quality) and the systemic weaknesses causing detraction.

NPS, in this sense, provides a macro-level view of brand health and customer loyalty.

4. Product-Focused Surveys

How do you know if a new feature is hitting the mark? Product-focused surveys help with this, gathering targeted feedback on specific functionalities or the overall product experience.

These can be deployed in-app after a user interacts with a new tool or sent periodically to power users. Questions might address usability, perceived value, and gaps in functionality.

This feedback is vital for product managers, helping them prioritize the product roadmap based on actual user value rather than internal assumptions.

5. Open-Ended Feedback Surveys

Sometimes, the most valuable insights come from asking a simple, broad question: ‘What's on your mind?’ or ‘How can we improve?’

Open-ended surveys forgo rating scales in favor of qualitative feedback. This format allows customers to share thoughts you didn't think to ask about, revealing unexpected pain points or opportunities.

And while the data is unstructured and requires more effort to analyze (often using text analytics), it prevents the bias inherent in multiple-choice questions. It also captures the customer's voice in their own words, providing rich, contextual insights that numeric scores cannot.

6. Exit Surveys

When a customer decides to leave, understanding their reason is critical for reducing churn. Exit surveys are typically presented during the cancellation process. The goal is not to reverse their decision in that moment but to diagnose the root cause: was it due to pricing, a missing feature, poor service, or a competitor?

This feedback is often brutally honest and provides an unfiltered look at your biggest weaknesses. Performing VoC data analysis here can reveal systemic issues affecting customer retention, allowing you to make strategic changes and prevent future churn.

Challenges with Traditional Voice of the Customer Surveys

Even the best VoC platforms stumble by measuring customer sentiment from surveys in a vacuum. They capture a point-in-score, like an NPS, but fail to connect it to the specific user actions that caused it. This creates a ‘what’ without the ‘why,’ leaving teams guessing about the root cause of feedback.

Another issue is response bias. Only highly satisfied or dissatisfied customers tend to reply, which skews the overall picture. Surveys also struggle with fatigue; long or frequent questionnaires push customers to skip or abandon them, reducing both the quality and quantity of insights.

A lesser discussed issue is survey timing. A quarterly email survey relies on a customer's fading memory, not their immediate experience. Furthermore, these broad surveys often lack context, asking a new user and a power user the same questions, which dilutes the insight for both segments.

Also, it is difficult to analyze VoC surveys from behavioral and operational metrics, making it difficult to connect feedback with concrete business outcomes.

How to Design Effective Voice of the Customer Surveys?

An effective survey is a precision tool, not a list of questions. Its design directly determines the quality of your data. To move beyond common, above-mentioned challenges and uncover true insights, focus on these core principles:

1. Prioritize Brevity and Respect Time

Every question should be easy to parse and answer. Avoid complex jargon or double-barreled questions that ask two things at once, like ‘How satisfied are you with our speed and customer service?’

The respondent cannot give a single accurate answer. Instead, break it down. Respect their time by prioritizing brevity.

Also, keep your surveys brief; long surveys that take more than five minutes to complete risk inaccurate responses or non-completion. Use microsurveys focused on specific interactions, like after a support call or a feature used to gather precise feedback (rather than one long, exhaustive questionnaire).

2. Leverage the Best VoC Platforms

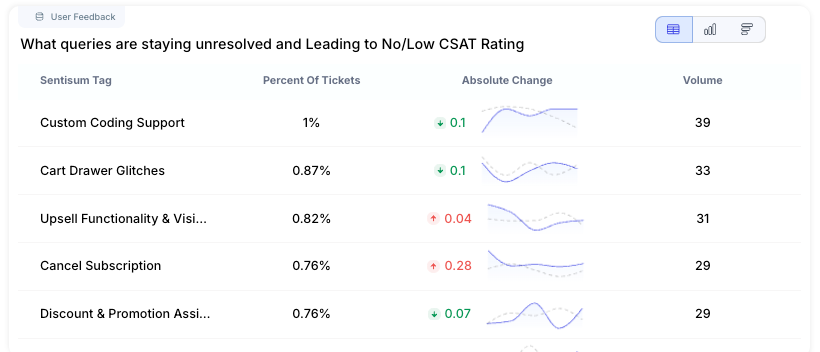

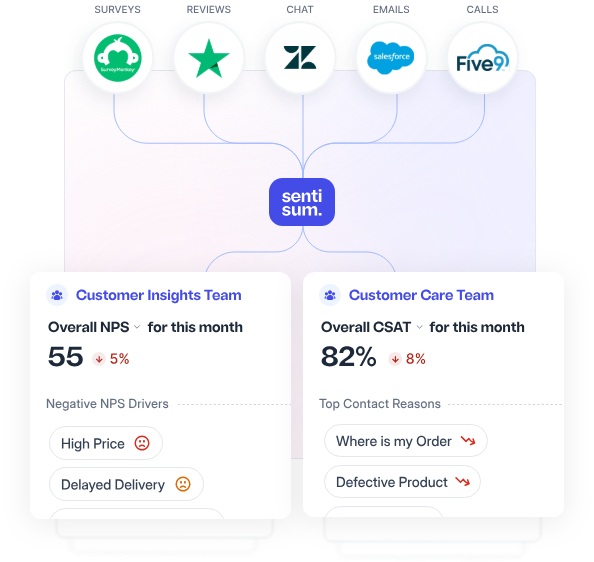

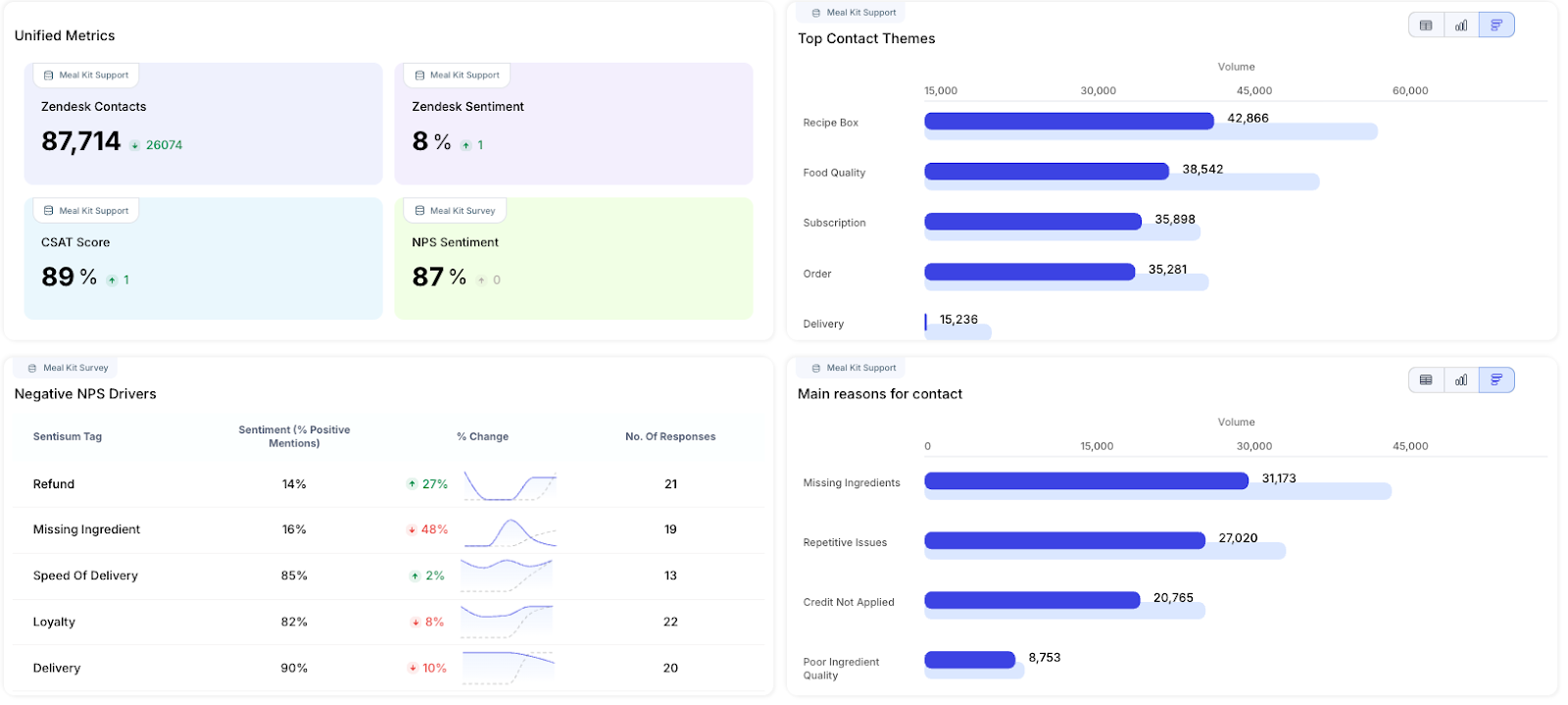

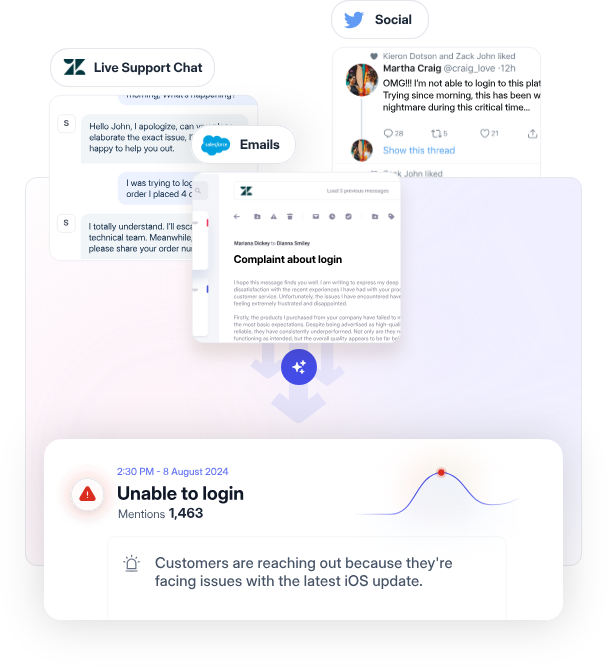

The market is saturated with options that often deliver surface-level data, leaving you with numbers but no narrative. SentiSum, an AI-native VoC platform, stands apart by going beyond simple metrics to expose the underlying reasons behind customer scores.

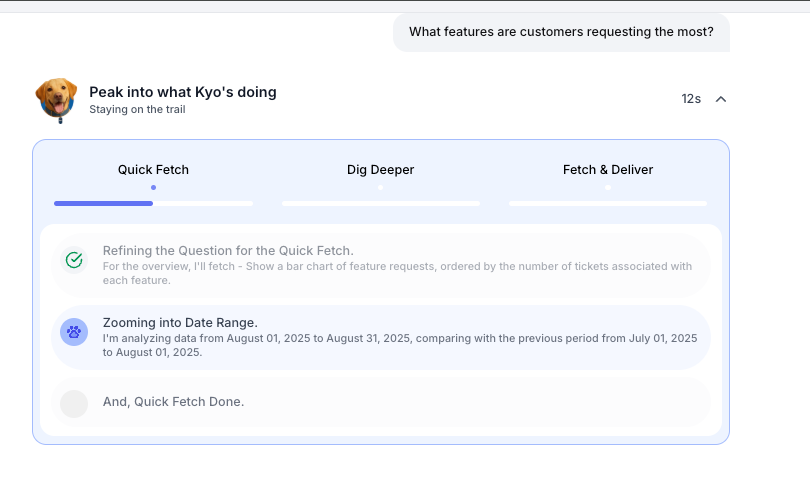

a. Uncover the 'Why' Behind Every Score

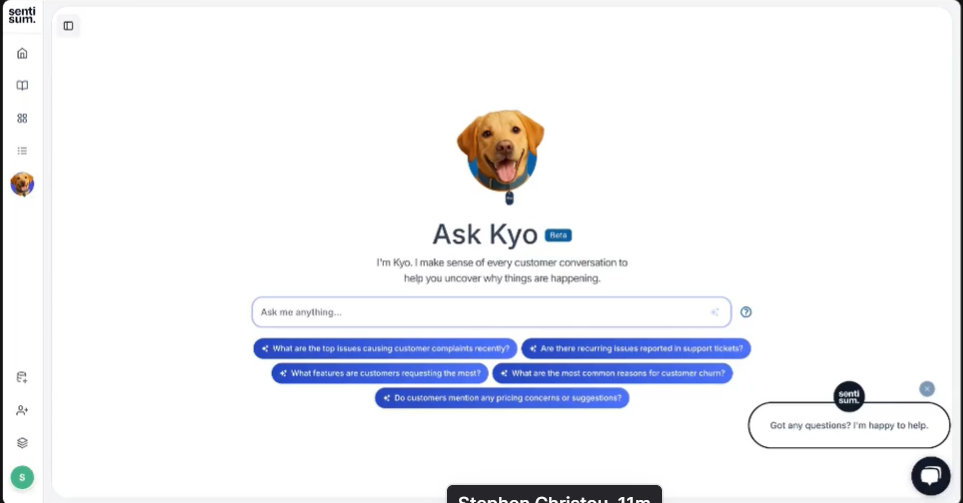

Many tools tell you a score dropped; SentiSum tells you why.

Using an advanced AI agent, Kyo, SentiSum analyzes every open-ended survey comment. This helps identify specific topics mentioned by customers, the sentiment behind each topic, and even flags issues indicating a high risk of churn.

In that sense, you see not just that CSAT fell, but that complaints about ‘delivery delays’ are the primary cause, enabling targeted fixes. This moves your team from tracking scores to understanding the context that drives them.

b. Gain Full Context for Scores Without Comments

A significant challenge with surveys is the lack of comments. SentiSum solves this by connecting survey scores to related support interactions.

If a customer gives a low NPS, for instance, but leaves no comment, the platform shows you the topics of their recent support tickets. This provides the missing context, revealing that the negative score likely stems from a previously unresolved billing issue.

This connection turns incomplete data into a complete picture, ensuring no feedback is left unexplained.

c. Integrate Seamlessly with SurveyMonkey

SentiSum’s integration with SurveyMonkey unlocks the full potential of your existing survey data.

With a single click, the intelligent AI agent Kyo pulls all your SurveyMonkey free-text responses for deep analysis. It automatically applies granular tags for topic and sentiment, transforming a list of comments into a structured set of insights.

This eliminates the tedious process of manually categorizing responses, giving your team immediate access to trends and drivers hidden within the feedback.

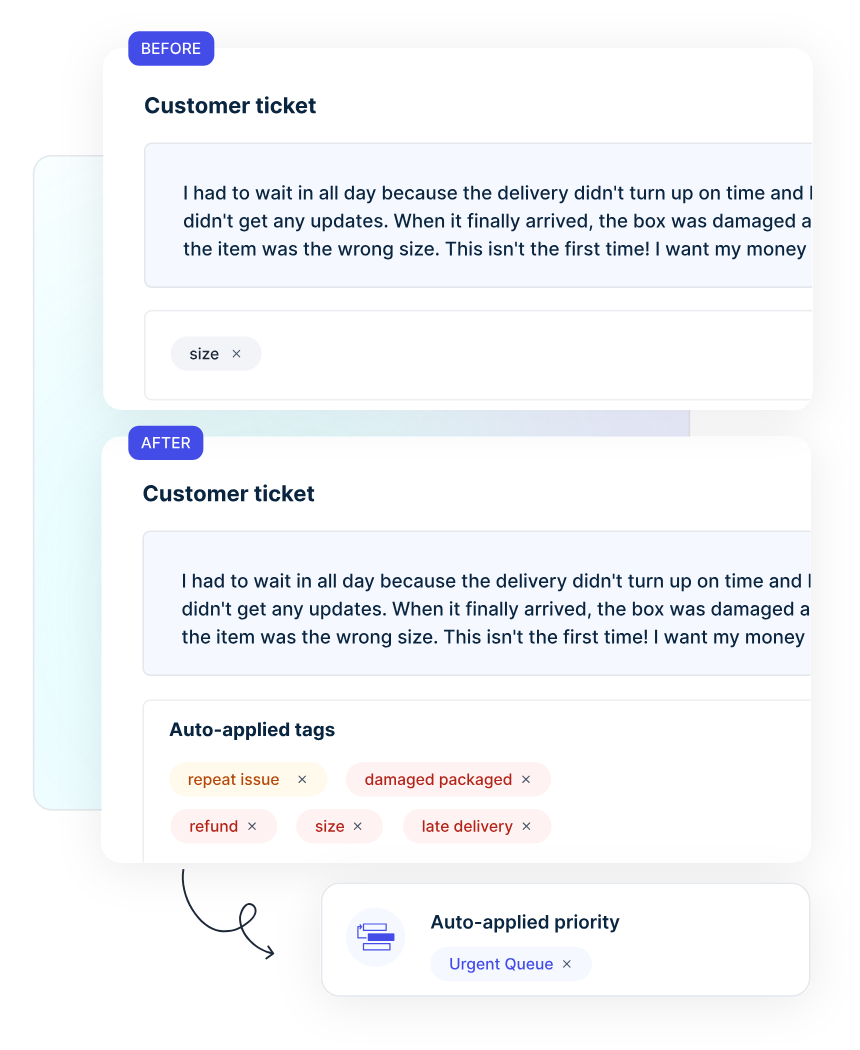

d. Automate and Customize Insight Delivery

SentiSum uses machine learning models trained on your specific historical data. This creates automated tagging and triggering systems that reflect your unique business language and customer concerns.

For instance, you can set up alerts for specific negative feedback topics, ensuring the right team is notified instantly.

This automation standardizes your analysis process, making it consistent and dependable while freeing your team from repetitive manual review tasks.

3. Focus on Question Sequencing

The order of questions can influence responses. Start with broad, easy-to-answer questions to build engagement. Gradually move to more specific or sensitive topics once the respondent is invested.

This ‘funnel’ approach feels more natural and yields higher-quality data than jumping straight into complex issues.

4. Bring Intentionality in Sampling and Frequency

Who you survey is as important as what you ask. Define your target audience with precision; for instance, survey users who have used a specific feature within the last week for feedback on that feature.

Surveying everyone can create skewed data; rather, use strategic sampling for more insightful and actionable data.

5. Balance Numbers with Narrative

Quantitative data (ratings, scales) provide the ‘what,’ while qualitative data (open-ended comments) reveal the ‘why.’ Combine them. Follow a quantitative question like, ‘How would you rate our onboarding?’ with an open-ended prompt such as, ‘What was the most confusing part?’

This structure makes analysis efficient while capturing the deeper context behind the scores.

6. Neutralize Bias in Questions

Leading questions, which hint at a desired answer, poison your data. A question like ‘How excellent was your experience today?’ assumes the experience was excellent.

A neutral alternative like, ‘How would you describe your experience today?’ with a balanced scale from ‘Poor’ to ‘Excellent’ can help remove bias and allow for truthful, negative feedback, which is often more meaningful.

AI-Driven Analysis of VoC Surveys: Why SentiSum Is Different

Almost 80-90% of traditional surveys are abandoned by customers. The number is alarming, surely, but not surprising. After all, surveys only capture structured, point-in-time feedback from a small, often biased segment of your customers. They tell you the whole story, and this is a major, major drawback.

CX leaders need tools that measure the real, unfiltered Voice of the Customers as found in the thousands of unstructured conversations happening daily: support tickets, phone calls, chat transcripts, and online reviews.

If you’re looking to move beyond traditional surveys, it is time to onboard VoC platforms that offer holistic solutions like SentiSum.

- Analyze 100% of Open-Ended Feedback Instantly

SentiSum’s AI agent Kyo reads and understands 100% of your qualitative feedback across all channels in real-time.

It further identifies precise subtopics and emerging trends that human analysts would miss, turning vast volumes of unstructured text into a structured, queryable database of customer intelligence.

- Detect Root Causes, Not Just Surface-Level Topics

Generic topic tagging is not enough to act on. SentiSum’s tailored AI model digs deeper to identify the root cause, such as ‘confusing international transaction fees’ or ‘delayed invoice emails’.

This granularity allows you to move beyond symptom management and implement precise fixes.

- Receive Proactive Alerts on Emerging Risks

SentiSum acts as an early-warning system by monitoring feedback streams for significant changes. It automatically alerts relevant teams via Slack or email when a specific issue, like a website checkout error, suddenly spikes in volume or negative sentiment.

This enables immediate investigation and resolution before the issue affects a wider customer base.

- Derive actionable insights from top integration

SentiSum integrates directly into the tools your teams use daily, like Zendesk, Jira, and Slack. It automatically routes specific feedback to the teams that can fix it, like sending product bug reports to developers or agent feedback to QA trainers.

This closes the loop, ensuring that customer voices directly inform product roadmaps and operational changes.

➡️ To know more, learn how SentiSum revitalized the broken legacy VoC:

Legacy Voice of the Customer (VoC) is Broken. SentiSum fixed it.

SentiSum moves you beyond simple survey collection to AI-driven analysis of customer feedback from all channels. Modern VoC isn’t about gathering more data; it’s about understanding customers' feedback beyond scores.

Explore how this approach wins by booking a demo.

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

.webp)

.png)

.webp)

.svg)