Retail brands lose a significant share of customers every year. Most never come to know why, until it’s too late.

Traditional surveys only reveal how customers felt after the damage is done, while AI-native Voice of Customer platforms can spot churn risks in real time, weeks before someone cancels or stops buying.

For subscription retailers and omnichannel brands alike, this shift from reactive feedback to proactive churn detection can protect millions in revenue. Of course, surveys still matter, but they need to feed into a system that helps you intervene early.

A thoughtful customer feedback survey for retail supports this by uncovering friction points, revealing unmet needs, and highlighting moments that influence buying decisions. It strengthens both online and in-store experiences and gives teams the clarity they need to reduce churn and grow customer loyalty.

In this blog post, we’ll walk through the best retail customer feedback survey practices that help retailers understand customer behavior, improve experience, and retain more customers.

8 Best Practices for Retail Customer Feedback Survey

Here are some proven best practices to design effective retail customer feedback surveys:

1. Define Clear Objectives

Before creating any questions, decide what you want to measure and why.

Are you checking satisfaction after a purchase, evaluating the checkout process, or reviewing customer support? Clear objectives help you write focused questions and avoid collecting irrelevant data.

For example, if you want to measure post-purchase satisfaction, ask about order accuracy, delivery speed, and ease of returns.

Feel free to skip unrelated topics like store layout.

When your survey has a clear focus, your analysis becomes easier. The insights you gather are also simpler to turn into action.

2. Keep It Short and Focused

Customers are more likely to finish a survey that respects their time. A good retail survey should take no more than 2–3 minutes. That’s usually about 5–10 well-chosen questions.

Avoid repeating questions or including topics that don’t fit your main goal. Each question should have a clear purpose and a specific role in your analysis.

Short, focused surveys help prevent response fatigue. They also improve accuracy because participants stay engaged and answer more thoughtfully.

When in doubt, remember this: quality responses matter more than the number of questions.

3. Use the Right Mix of Question Types

An effective survey strikes a balance between quantitative and qualitative data.

- Quantitative questions (rating scales, multiple choice, or numeric responses) make it easy to measure satisfaction and identify trends over time.

Example: “How satisfied are you with your checkout experience today?” (1–5 scale)

- Qualitative questions (open-ended) reveal the 'why' behind the numbers, helping you understand customers' emotions, frustrations, and expectations.

Example: “What could we improve about your checkout process?”

Combining both provides a more comprehensive view of customer sentiment. Quantitative data highlights problem areas, whereas qualitative responses explain the reasons behind them, guiding more informed decisions.

4. Personalize the Survey

Each customer follows a different path, so your surveys should reflect those varied experiences. Tailor questions based on customer type, purchase history, or interaction point.

For example, a first-time shopper might get questions about onboarding. A loyal customer could be asked about product satisfaction or their loyalty program experience.

Online buyers can share feedback about website usability. In-store shoppers might rate staff service or checkout speed.

Personalized surveys increase engagement and response quality. Customers feel the questions match their experience. When people believe their feedback will lead to real improvements, they give more honest and thoughtful answers.

5. Choose Integrated Tools

Unlike tools like Qualtrics and Medallia, which are an AI-driven retail customer survey, SentiSum uses AI to detect churn and drive retention. It predicts at-risk customers and suggests targeted actions, all while integrating seamlessly with your CRM, POS, or email marketing platforms.

Integrated systems automate feedback collection and enable omnichannel tracking, so whether a customer buys online or in-store, their feedback feeds into a single unified dashboard.

This makes it easier to spot recurring issues, segment feedback by customer type, and measure the impact of changes over time. Scalable tools also allow you to distribute surveys efficiently across multiple channels and scale up as your business grows.

6. Optimize Timing and Channels

Send surveys immediately after an interaction, right after checkout, delivery, or customer support resolution, while the experience is still fresh in the customer’s mind.

Also, deliver surveys through the channels customers already use. For retail, this could mean:

- Email surveys post-purchase

- SMS links after in-store visits

- In-app or website pop-ups for online shoppers

- QR codes are printed on receipts or packaging for convenience

Meeting customers where they are increases participation rates and captures more accurate, real-time sentiment.

7. Encourage Participation

Incentivize participation with small rewards like loyalty points, discount codes, or contest entries. These simple gestures show appreciation for customers’ time and help boost completion rates.

Beyond incentives, communicate the importance of feedback. Explain how their opinions help you improve products, services, and experiences. Customers are more likely to engage when they know their input will lead to tangible improvements.

You can also use progress bars or short introductory text to make surveys feel lighter and more approachable. The goal is to make participation easy, valuable, and meaningful.

8. Close the Feedback Loop

After analyzing the results, share the insights with all departments and make changes where needed. This might mean refining store layouts, improving product descriptions, or retraining customer service teams.

Most importantly, let customers know when their feedback leads to change. A simple follow-up email saying “You asked, we listened” builds trust and shows accountability.

This kind of transparency validates your survey efforts and encourages customers to share feedback again.

Closing the loop turns surveys from a one-way questionnaire into an ongoing conversation that strengthens loyalty and brand credibility.

4 Key Metrics to Track in a Best Retail Feedback Survey

Tracking the right metrics helps you measure satisfaction, predict behavior, and identify opportunities for improvement. The following are essential metrics every retail business should include in their feedback framework:

1. Customer Satisfaction Score (CSAT)

CSAT measures how satisfied customers are with a specific experience or interaction. It’s often captured through a simple question like:

“How satisfied were you with your shopping experience today?”

Respondents rate their satisfaction on a scale (e.g., 1–5). To calculate CSAT:

Customer Satisfaction Score gives you a snapshot of short-term satisfaction, helping you pinpoint areas that directly affect immediate customer happiness, such as checkout efficiency, store layout, or product availability.

2. Net Promoter Score (NPS)

Net Promoter Score measures customer loyalty and the likelihood of referrals. The question is straightforward: “How likely are you to recommend our store to a friend or colleague?”

Responses fall on a 0–10 scale and are grouped as:

- Promoters (9–10): Loyal customers who advocate for your brand

- Passives (7–8): Satisfied but not enthusiastic

- Detractors (0–6): Unhappy customers who may discourage others

To calculate NPS:

A high NPS signals strong customer loyalty and strong potential for positive word of mouth. Tracking it over time reveals how well your CX improvements resonate with customers.

3. Customer Effort Score (CES)

CES measures how easy it was for a customer to complete a specific action, such as returning a product or finding an item online. The typical question is: “How easy was it to resolve your issue or complete your purchase today?”

Customers rate their experience on a 1–7 scale, with lower effort correlating to higher satisfaction and loyalty.

Retailers with frictionless experiences, fast checkout, easy returns, and clear communication retain more customers. CES helps you find and eliminate pain points that create unnecessary effort.

4. Customer Retention and Churn Prediction

While CSAT, NPS, and CES provide snapshots, retention and churn analysis give a broader view of long-term customer behavior.

Tracking repeat purchase rates, visit frequency, and average order value helps you predict churn risk and design targeted retention strategies. Reducing churn by even a few percentage points can significantly increase profitability.

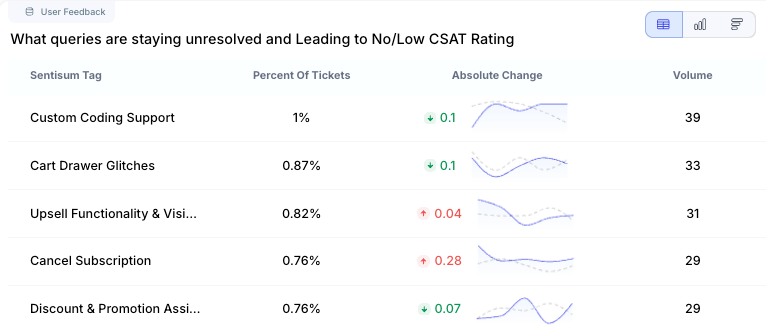

Combining feedback data with behavioral analytics allows you to identify early warning signs, such as declining satisfaction scores or reduced purchase frequency, and take proactive measures.

How SentiSum Prevents Churn in Retail

For retail businesses, especially subscription-based models, SentiSum transforms feedback from a reporting exercise into a retention engine.

Here are the major capabilities SentiSum offers:

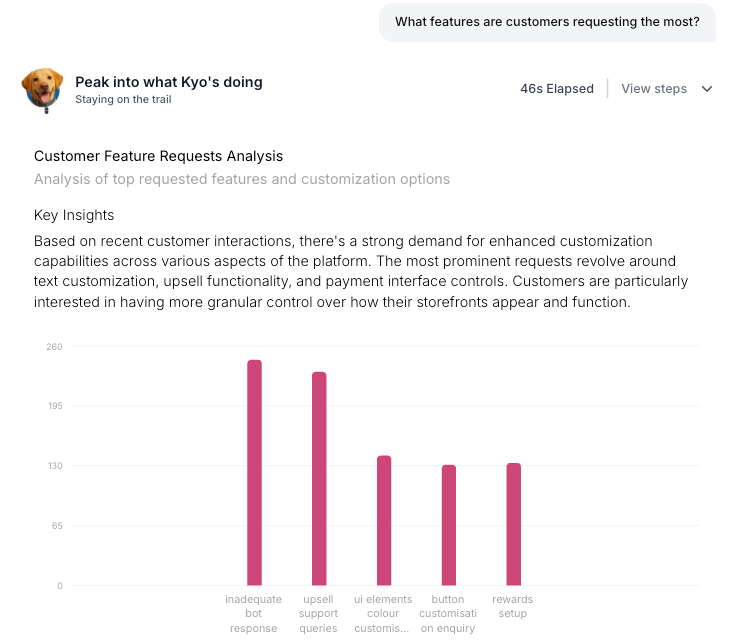

1. Real-Time Churn Detection with Kyo

Kyo is SentiSum's most intelligent AI yet. It's the brain behind the platform. Kyo unifies all your customer feedback into one brain and instantly detects what's breaking and why.

When multiple customers report “shipping delays” or “out-of-stock items,” Kyo flags potential churn risks before satisfaction scores drop.

This way, retailers can intervene several weeks earlier than traditional survey-based approaches, giving CX teams time to act.

2. Cross-Channel Pattern Recognition

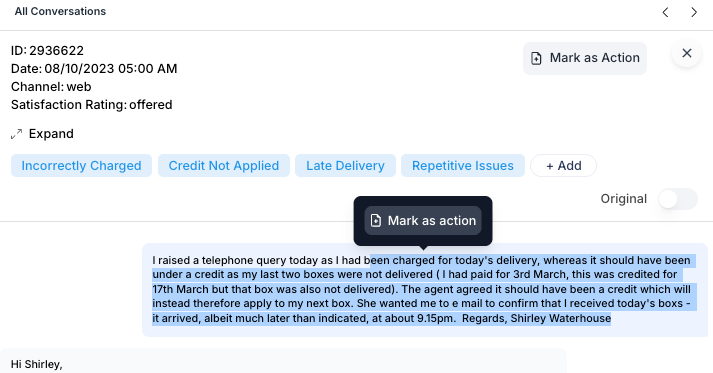

SentiSum consolidates support tickets, reviews, survey responses, social mentions, and CRM notes into a single unified view.

This reveals retention patterns that single-channel surveys miss, like customers who rate CSAT positively but show frustration in support conversations.

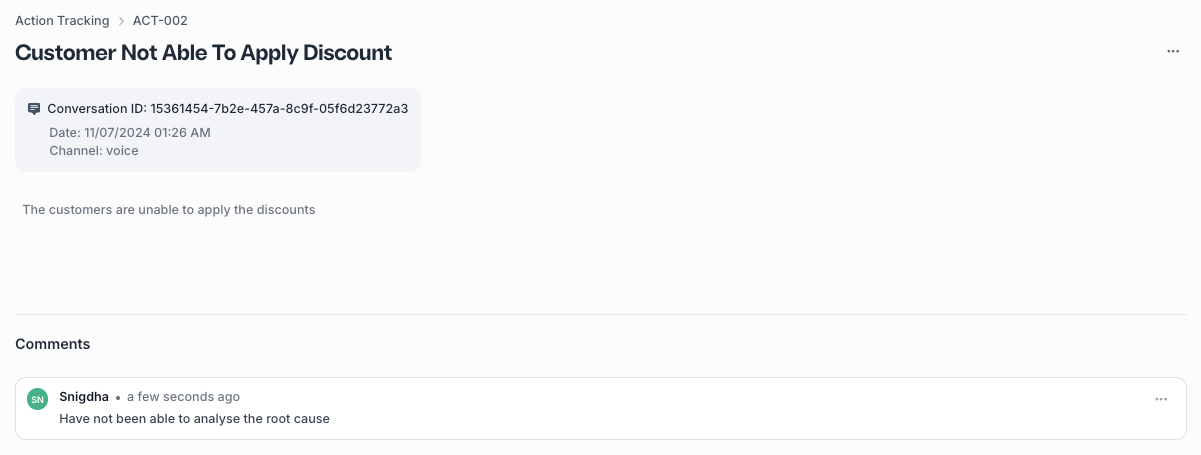

3. AI-Recommended Actions

Retail teams receive actionable recommendations instead of guessing next steps. Kyo's Insights Agent recommends and triggers the next best action based on feedback patterns.

For example, when product availability issues spike among high-value customers, teams get clear guidance on intervention strategies to prevent cancellation. This ensures timely, personalized interventions that reduce churn.

4. Detect Recurring Issues Before They Impact CX

For support teams, SentiSum highlights recurring problems across stores, e-commerce, and mobile apps, helping prevent satisfaction score drops.

5. Surface Feature Requests That Support Retention

For product teams, it identifies feature requests from feedback, helping prioritize roadmap decisions that support retention goals.

6. Connect Feedback to Churn Indicators

For leadership, SentiSum links trends in feedback to churn indicators and business outcomes, providing a clear line of sight from customer sentiment to retention performance.

With SentiSum, retailers don't just analyze survey data; they turn insights into actions that improve customer experiences, reduce friction online and in-store, and increase loyalty and retention.

Go From Insights to Impact with SentiSum

Customer feedback surveys help retailers understand what shoppers like, what frustrates them, and what keeps them coming back.

When used correctly, they guide better decisions, whether that means improving product availability, resolving slow checkout lines, or creating a smoother online experience. The real value comes when retailers act on the insights, not just collect them.

Tools like SentiSum make this easier by analyzing survey data in real time, showing you what’s going wrong and how to fix it fast.

Book a demo today with SentiSum and discover how to turn feedback into real results.

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

.webp)

.png)

.webp)

.svg)